Have you recently moved to Oregon? Or maybe it’s been a while, but you just didn’t think about updating your estate plan to protect your estate against Oregon’s death taxes, formerly known as inheritance tax.

You may not know that Oregon death tax laws differ substantially from other states, and those tax laws may put your existing estate plan at risk of being heavily taxed on your death. If the unthinkable happens, and you pass away without updating your trust or will, it could cost your loved ones a large portion of your estate in death taxes.

That’s fine if you don’t mind paying part of your estate to the Oregon Department of Revenue, but I have yet to find anyone who is willing to knowingly do that. Even if you’ve done tax planning for your estate in the past, it’s important to meet with an attorney with expertise in Oregon estate and tax law to make sure that your estate will go to your loved ones without unnecessarily paying a portion to the State of Oregon.

What Are Estate Taxes or Death Taxes?

An estate tax is a tax on the transfer of assets from one generation to the next, such as between parents and heirs. The tax is generally imposed on the total estate value and any gifts made prior to the person’s death above a predetermined exempt amount that varies by state. As of 2023, individuals will be allowed to transfer up to $12.92 million without triggering the federal estate tax, higher than the $12.06 million exemption amount in 2022.

Oregon Estate Tax Rate

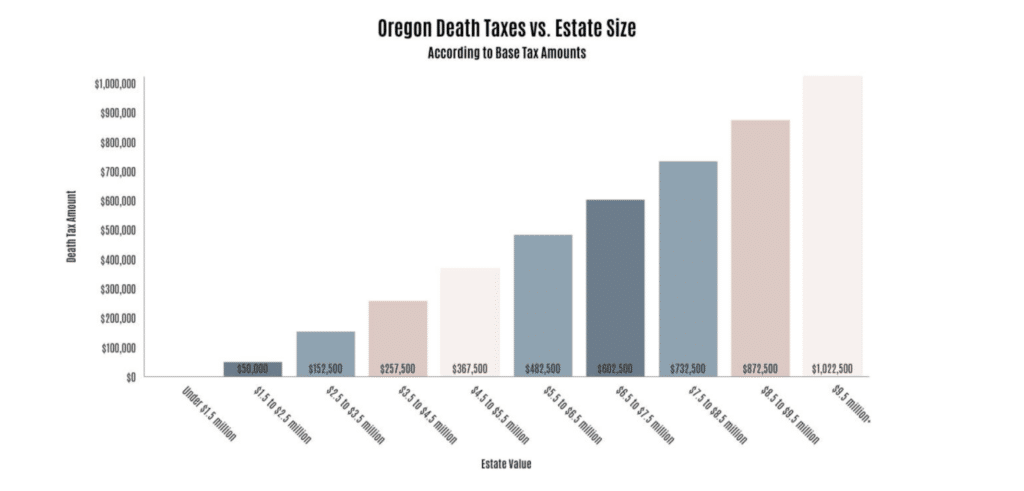

Those who move to Oregon from other states are often surprised by Oregon’s death tax laws. For example, California and Texas don’t have state death taxes. In Washington State, estates exceeding $2 million per individual are taxed. Unlike other states, Oregon charges death taxes on assets over $1 million, ranging from 10% to 16%.

Residents of Oregon are subject to death taxes, regardless of whether they own assets in another state (for example, if you own property in California, Oregon would charge death taxes on the value of your California property). You might think $1 million is a lot, but add up your assets (real estate, bank accounts, investments, retirement accounts, life insurance, vehicles, personal property). The value of your estate may already exceed $1 million.

An example would be a $2 million estate owned by mom and dad. After dad dies, everything passes to mom (whether in trust or by will). Oregon will exempt the first $1 million of a $2 million estate from death tax and collect death tax on 10% to 10.5% of the remaining estate – that’s over $100,000 going to the State of Oregon and not to mom and dad’s heirs.

As illustrated by the graph below, the State of Oregon would take progressively larger sums if mom and dad had a large estate:

Estate Planning

There are legal ways to avoid paying Oregon death taxes and there is nothing wrong with using legal methods to pay as little tax as possible. As of now, the Federal government is not taxing individual estates of less than $11.58 million, so most estates will avoid Federal estate taxes. The current Federal estate tax law is set to change in 2026, however.

Bottom line: Oregon death taxes apply to all of your assets that you own at your death if you are an Oregon resident, even those outside of Oregon. Do you own a home in California or Arizona? Those are part of your taxable estate as an Oregon resident and may cost your estate large sums of money without proper estate planning.

The Good News: With proper estate planning, you can eliminate, or at least minimize, the death tax the State of Oregon takes from your estate.

There are many options to avoid paying Oregon death taxes:

- Bypass trusts

- Lifetime giving

- Charitable giving

- Irrevocable Life Insurance Trusts

You should get on top of it now so that your estate, and your loved ones who you would like to inherit from you, don’t have an unwelcome bill from the Oregon Department of Revenue upon your death.

Estate Tax vs. Inheritance Tax

The term “death taxes” refers to both estate and inheritance taxes. Both are assessed upon the death of an individual. However, there is one important difference between the two: who pays the tax.

With estate taxes, the estate pays tax on the decedent’s estate and the inheritor receives their inheritance tax-free. Inheritance taxes are assessed on the individual receiving the inheritance.

The state of Oregon has an estate tax, but no inheritance tax.

Is There a Deadline for Filing Estate Tax?

Nine months after the date of death is the deadline for filing a death tax return. If the executor needs more time to file the return, he or she can request an extension of six months. Returns are subject to extension, but tax payments are not. Taxes that aren’t paid on time are subject to penalties and interest.

Contact De Alicante Law Group for Estate Planning

Tony De Alicante earned an LLM (Master of Laws in Taxation) from Georgetown University, providing him with a broader perspective than your typical estate planning attorney. Contact Tony today to schedule a consultation to revisit your estate and tax plans that were formed in another state.

De Alicante Law Group is an estate planning, probate and business law firm based in Bend, Oregon. Founded in early 2013 by Oregon native and veteran, Tony De Alicante, De Alicante Law Group is proud to serve people from across the state of Oregon. De Alicante Law Group is currently utilizing protective Covid-19 remote legal service methods (video conferencing, email, phone, postal service) as much as possible to protect its clients and staff, and actively travels to client’s homes for meetings as needed.

Recent Comments