Estate planning (i.e., preparing a will, a trust, or using other probate substitutes) is not an easy thing to think about, especially for younger adults. You still have your whole life ahead of you. If you or a loved one pass away without a valid estate plan, then the State of Oregon dictates who receives your estate, and it may not go to who you want to receive it. You’ll have no control over what happens to everything you own, including real estate, money, investments, and all other belongings of value.

What is Intestate Succession?

Intestate succession is the legal term for the distribution of an estate when someone passes away without a valid estate plan. It is the state’s requirement of who receives your property if you did not have a valid estate plan in place upon your death.

Dying intestate usually requires your estate to go through probate before distributing it to your heirs. You may have an estate plan, but it may not be valid if you haven’t done it according to the requirements of the state in which you made the plan.

If you don’t have a valid estate plan upon death, the State of Oregon has one based on intestate succession laws. Oregon’s intestacy laws control who receives your property and how much of it, regardless of whether you want those designated by the intestacy laws to receive it.

In many cases, De Alicante Law Group has seen Oregon intestacy laws distribute estates contrary to what the deceased person wanted. This is prevented with proper estate planning.

What Happens When You Die Without a Valid Will in Oregon?

Oregon laws determine what happens to your estate if you die without a valid estate plan, usually a will or a trust, based on the following rules.

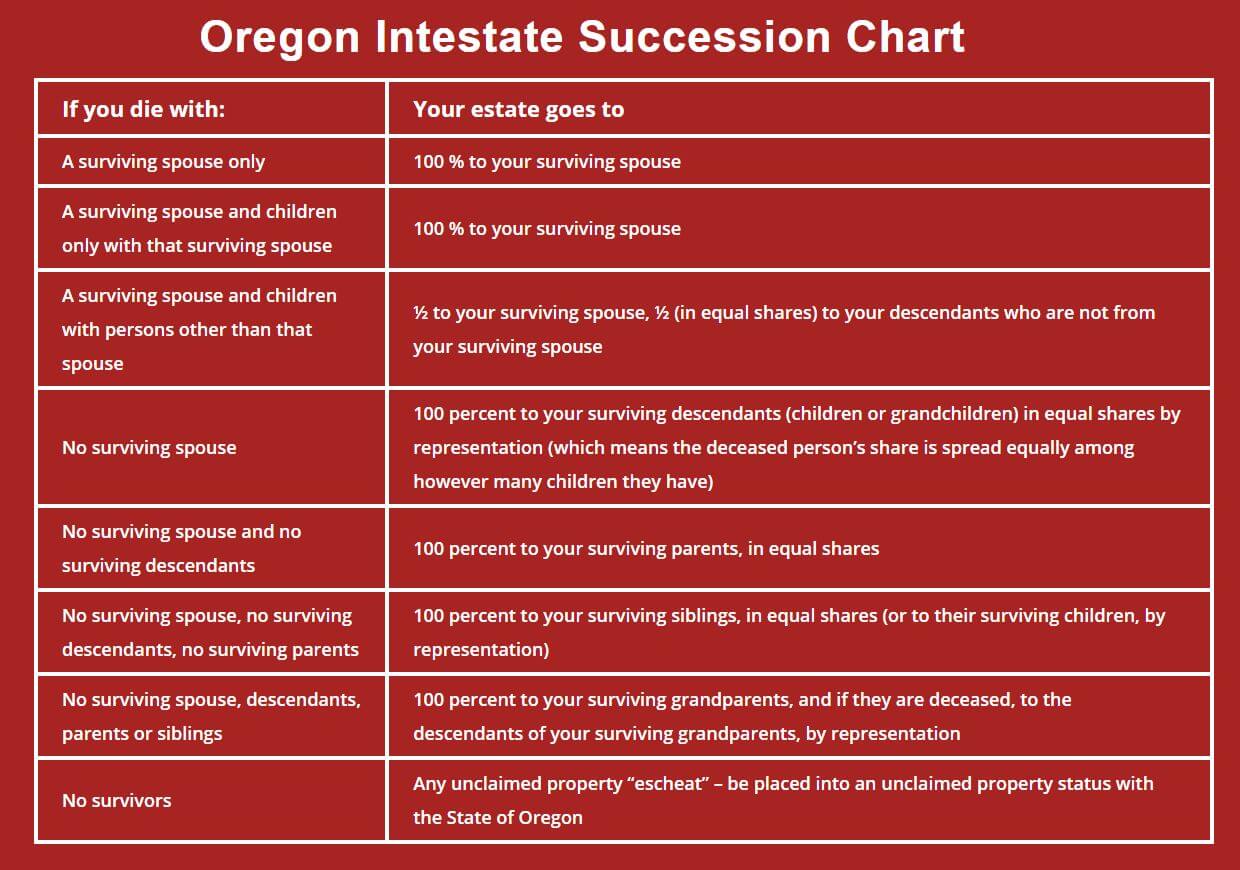

Oregon Intestate Succession Chart

- If you die with a surviving spouse only: If you have no other immediate family besides a spouse, 100% of your estate goes to your spouse.

- If you die with a surviving spouse and children only with that spouse: The same as above, 100% of your estate goes to your spouse. Notably, 0% of your estate is directed to your children.

- If you die with a surviving spouse and children with persons other than that spouse: In this case, 50% of your estate goes to your spouse, and the remaining 50% is split equally among your children who are not from your surviving spouse.

- If you die with no surviving spouse: If you are survived by children, but no spouse, 100% of your estate goes to your surviving children. in equal shares. If you have surviving children and one or more deceased children who have left children of their own (your grandchildren), the grandchildren would share in your deceased child’s share of your estate.

- If you die with no surviving spouse and no surviving descendants: 100% of your estate goes to your surviving parents in equal shares.

- If you die with no surviving spouse, no surviving descendants, and no surviving parents: If your siblings are your closest surviving family members, they will receive 100% of your estate split in equal shares (or to their surviving children, by representation).

- If you die with no surviving spouse, descendants, parents, or siblings: 100% of your estate goes to your surviving grandparents, and if they are deceased, to the descendants of your surviving grandparents, by representation.

- If you die with no surviving immediate relatives, any unclaimed property is escheated in this unfortunate situation. This means it will be placed into an unclaimed property status with the State of Oregon. If after 10 years no claim is made for the property, the escheated property becomes owned by the State of Oregon.

What Assets Are Involved in Intestate Succession?

In Oregon, intestate succession laws only impact assets that pass-through probate. Many assets don’t transfer through probate and are not influenced by these laws. These can include:

- Real estate or personal property that you’ve allocated to a living trust;

- The proceeds from a life insurance policy where a beneficiary is already specified;

- Retirement savings in accounts like a 401(k), IRA, etc., where a beneficiary is designated;

- Financial accounts where a payable-on-death beneficiary is designated;

- Properties that you’ve deeded in a transfer-on-death;

- Automobiles that are held joint with survivorship with another individual;

- Bank accounts with a designated payable-on-death beneficiary;

- Assets co-owned with another individual in a joint tenancy arrangement with survivorship or as tenants by the entirety (which is only between spouses).

These assets will typically pass to the surviving co-owner or the beneficiary you specified, regardless of whether you have a will and without requiring a probate proceeding. However, if you don’t have a will and none of the named beneficiaries are alive, the property could be transferred according to intestate succession laws. It’s crucial to consider these factors when planning your estate to ensure your assets are distributed according to your wishes.

Read More: How to Avoid Probate in Oregon

How to Avoid Intestate Succession

To avoid the complexities and uncertainties of intestate succession, having a well-crafted will or trust in place is crucial. Wills and trusts enable individuals to have control over the distribution of their assets and ensure that their wishes are upheld after their passing. You can clarify and ease the burden on your loved ones during an already difficult time by outlining your desires regarding inheritance, guardianship of minor children, and even end-of-life decisions.

We understand the importance of comprehensive estate planning at De Alicante Law Group. We can assist you in creating a personalized plan that reflects your unique circumstances and objectives. By working closely with you, we will help you establish strategies to protect your assets, provide for your family’s future, and minimize or eliminate expenses associated with the probate process.

Don’t leave your legacy to chance – contact us today to ensure your estate is handled according to your wishes and secure peace of mind for yourself and your loved ones.

Recent Comments